Tax season is here and while many dread doing their taxes, it’s not so bad with the right software. Many people assume you have to pay for expensive software to file your taxes but in reality, there are excellent free options which I will be exploring here.

As a reminder, taxes are due April 15th.

The IRS website lists every available free tax prep software. To apply, you’ll have to have a gross income of less than $60,000 per year. If you make more than that, you can manually fill out IRS forms for free, but you’ll probably want to pay for tax software to make things easier.

For the purposes of this list, I will focus on software that works in all 50 states and only on free filing for federal returns. Filing state tax returns usually have a fee and will differ with each software solution.

One thing to note is that free tax preparation software is mainly for those with simple financial situations. If you own multiple properties or your own business, you’ll probably want to pay for premium software or hire a certified public accountant.

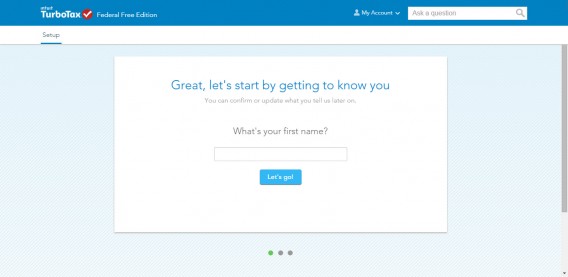

TurboTax Federal Free Edition

TurboTax is one of the biggest names in tax prep software and for good reason. Even in this free edition, TurboTax is extremely well thought-out and easy to use. Everything is laid out in simple pages so you’re not overwhelmed and it boasts a detailed explanations if you ever find yourself confused.

Just about every tax form is supported, even in this free version. For a full list of supported forms, check out TurboTax’s comparison chart.

One of the things I like most about TurboTax is how many steps it saves. TurboTax has a partner program where employers can sign up to allow the software to auto-import your W-2. You can also import information from last year’s tax return but you will have to pay. This is annoying since TurboTax already has all your information but won’t fill it out for you unless you pay.

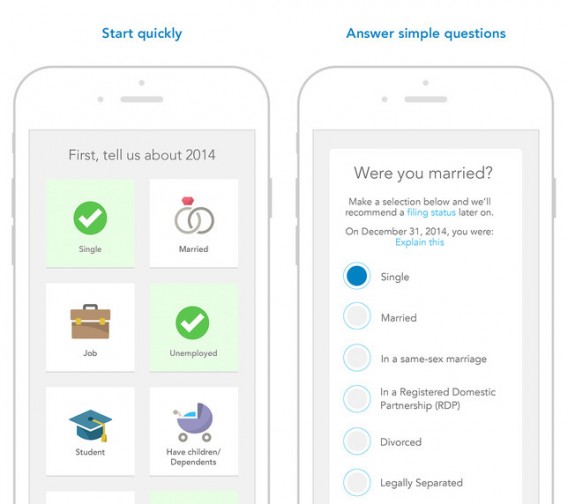

For those who want to file on the go, there are TurboTax apps on just about every platform from Android to iOS. These apps make filing a bit easier, letting you import your W-2 by taking a photo.

Get started with TurboTax Federal Free Edition

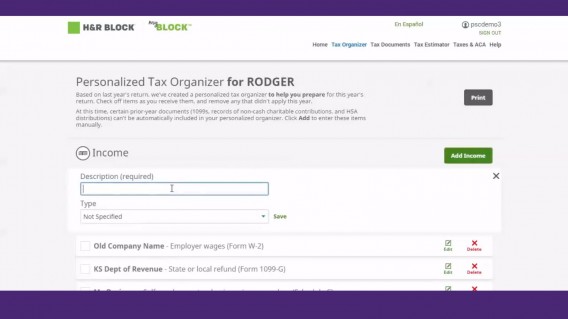

H&R Block Free Edition

You can’t mention TurboTax without also mentioning its main rival, H&R Block. That’s because the two share many similar features so it’s a tossup between the two. H&R Block also includes an auto W-2 import and a very easy to use interface.

H&R block supports basically every tax form. For a full list of supported forms, check out their PDF.

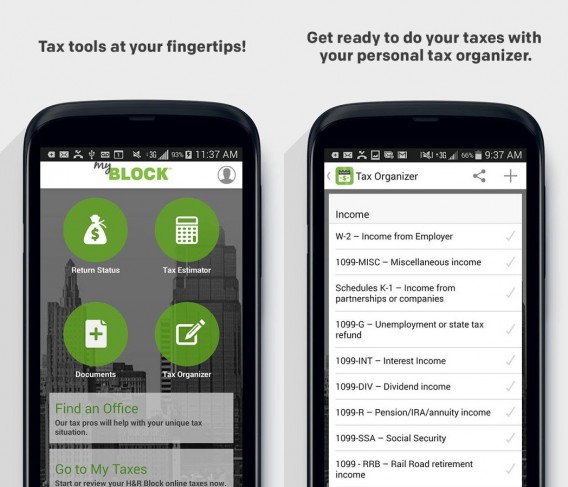

There are H&R Block apps but they’re not very good. User reviews are pretty terrible and the software doesn’t look to be useful for free users. I would stick with using H&R Block Free in your browser.

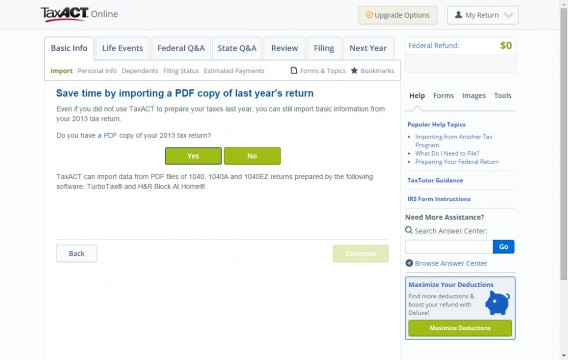

Like TurboTax, H&R Block saves time by importing last year’s tax return so you don’t have to manually fill out basic information. H&R Block supports importing from TurboTax, TaxACT and of course your previous year’s H&R block return. This gives H&R Block an advantage over TurboTax, which requires you to pay to import your old information.

Everything is well laid out and will walk you through confusing questions. If you’re still confused, you can visit one of the many H&R Block offices for help, something TurboTax doesn’t offer.

Get started with H&R Block Free Edition

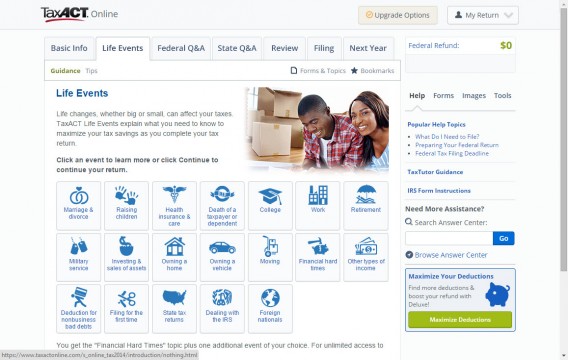

TaxACT Free Federal Edition

Although not as popular as H&R Block or TurboTax, TaxACT is actually very good. It includes many of the features included with the other two like auto import of last year’s return. You can import via a PDF of last year’s return, even from TurboTax and H&R Block.

TaxACT stands behind its product with free user support. There’s also a great Tax Glossary to help you work through tough terminology. The company also offers audit protection by comparing your tax return to last year’s, looking for inconsistencies. It’s a nice perk but isn’t going to be as helpful as having in-person audit support that’s offered by some of the bigger competitors’ paid products.

Using TaxACT is simple. Its interface is logically laid out and like other software, it doesn’t overwhelm you with a huge list of options to choose from. Life events are broken down into easy to comprehend icons and everything is conducted like an interview. You also get a live update on the side of how much money you will be getting back with your return.

TaxACT also has apps for Android and iOS for you to file on the go. Like other mobile tax software, your work is synced so you can pick up where you left off on the web or on your tablet.

Get started with TaxACT Free Federal Edition

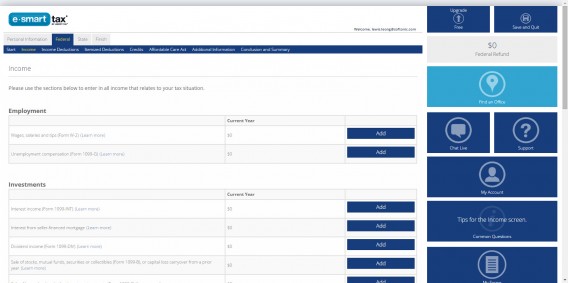

eSmart Tax

eSmart Tax makes saving time easy. It also imports last year’s tax return but it also can import returns completed with competing software via PDF. This is great if you’re unhappy with the tax software you used last year and want to try eSmart Tax instead.

The interface isn’t as intuitive as some of its other competitors but it’s not bad. On the web, there’s a ton of empty space that could have been better used instead of spreading out text.

In terms of support, eSmart Tax offers live chat on its website, though its clunky and slow. If you want to speak with a human being, eSmart Tax offers in-person tax preparation using Liberty Tax Service.

Get started with eSmart Tax

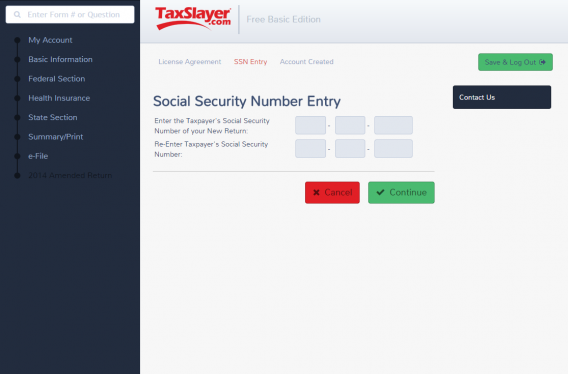

TaxSlayer Free Federal Edition

I really like TaxSlayer’s interface. Everything is laid out in big, easy to read buttons and text fields. It also provides first time users with an in-depth tutorial, highlighting all of the different features of the software.

However, TaxSlayer Free does have a big downside: it doesn’t import your previous year’s tax return. You’ll have to step up to a paid version of TaxSlayer for the feature, which is disappointing since some competitors include it for free.

In terms of support, TaxSlayer offers free email and phone support, but no online chat. You’ll also have to call in during available hours because 24/7 phone support isn’t available. TaxSlayer will also make sure to check for errors and inconsistencies in your tax return before submitting it.

Get started with TaxSlayer Free Federal Edition

TaxSimple

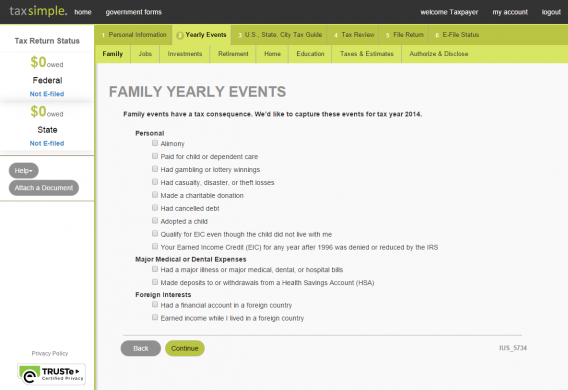

TaxSimple is my least favorite in this list but it still works well. The main issue I have with TaxSimple is how slow it is. Every action is greeted by a loading screen, which takes a few more unnecessary seconds than it should.

If you can get over its slightly laggy performance, you’ll be treated with a live return status on the sidebar and easy survey-like interface. There’s also live chat if you’re ever confused about something.

TaxSimple also guarantees to pay any IRS fines for inaccurate reporting, which is a nice peace of mind.

Get started with TaxSimple

Wrap-up

As you can see, the tax software included in this list are all extremely similar. The main differentiators between them are their support, accuracy guarantees, and audit protection. The Affordable Care Act will add something new to this year’s return but all of the software covered in this list include sections for the ACA.

If you have a simple financial situation, any of these free tax prep software will work well for you but my favorite is H&R Block. I like H&R Block the best for its ability to import your previous return and its easy to use interface. You’ll also get great support online, over the phone, or in person at one of their many locations. Although H&R Block’s mobile applications aren’t very good, its core website is excellent.

There’s no need to purchase the premium versions as you won’t take advantage of the additional features. But if you have more complicated tax needs, you’re better off paying for premium versions of these apps or hiring an accountant.

Header image credit: Ken Teegardin

Related Stories

Best apps for planning your budget ski vacation

Follow me on Twitter: @lewisleong