This week Google announced that Android‘s Google Wallet now supports all major credit or debit cards. This move expands the usability of Near Field Communication (NFC) payments beyond the MasterCard PayPass or prepaid cards that used to be the only way to pay. Using a cloud-based version of the app, you can apply almost any card you own to pay at NFC payment points. The use of NFC payments has been slow to pick up in the United States, but more and more businesses are adopting NFC as a payment system.

This week Google announced that Android‘s Google Wallet now supports all major credit or debit cards. This move expands the usability of Near Field Communication (NFC) payments beyond the MasterCard PayPass or prepaid cards that used to be the only way to pay. Using a cloud-based version of the app, you can apply almost any card you own to pay at NFC payment points. The use of NFC payments has been slow to pick up in the United States, but more and more businesses are adopting NFC as a payment system.

Even with Google Wallet supporting all major credit and debit cards, there is still one large barrier that makes the app next to useless – wireless carriers. Sprint is currently the only formally supported carrier that allows Google Wallet natively.

There are workarounds, requiring rooting or installing a custom ROM. It’s frustrating that a payment system exists for Android users, but is unavailable because of access denial by carriers.

How long do Android users have to wait until they can actually use Google Wallet natively? Could it be forever?

Carriers are the barrier

If you consider Google Wallet’s refresh to support major credit cards a rebirth, the idea behind Google Wallet is great. It can replace a payment method and still be attached to your Google Play account where you purchase media and download apps. Using NFC as a touch payment system simplifies the time spent at registers and cuts down on the amount of physical cash you carry.

If you consider Google Wallet’s refresh to support major credit cards a rebirth, the idea behind Google Wallet is great. It can replace a payment method and still be attached to your Google Play account where you purchase media and download apps. Using NFC as a touch payment system simplifies the time spent at registers and cuts down on the amount of physical cash you carry.

I welcome the idea of using my phone to pay for purchases. Since my Samsung Galaxy S3 is my primary communication tool with social networks, email, and nightly YouTube viewing sessions, adding one more function is fine by me.

Verizon doesn’t support Google Wallet because they are working on their own payment system, Isis. I think when they launch their own NFC payment system, there’s going to be an option to connect it to my monthly bill or pay a premium to direct all purchases to a card. With this methodology, they’re going to get a bigger percentage of the bill for processing the payment rather than allow usage of Google Wallet.

Finally showing some progress, Verizon announced that they are allowing the Samsung Galaxy Nexus to use Google Wallet. Possibly in the near future, more smartphones will be unlocked and other carriers will stop denying access to the app.

This is the problem with the carrier space. They can lock down features that are beneficial for customers in favor of what benefits them as a business. I can understand that they need to monetize as much as possible, but Google Wallet isn’t a third-party app; it’s becoming an essential part of the Android operating system.

Security

Google can say that their servers are secure, but we’ve seen that no company can claim this one hundred percentage. Even with that “risk,” I do think Google will be taking security very seriously. Security was one of the big reasons that Verizon originally stated why they weren’t supporting Google Wallet in the beginning. Then Verizon revealed that they were developing their own payment system.

Security was one of the big reasons that Verizon originally stated why they weren’t supporting Google Wallet in the beginning. Then Verizon revealed that they were developing their own payment system.

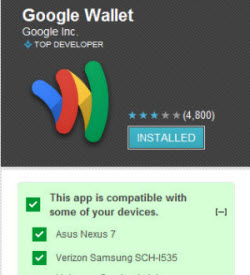

Security and ease of use are the two biggest obstacles that Google Wallet have right now. It’s available through one wireless carrier or the Nexus 7. Since Google is pushing the use of NFC beyond payments for other uses, like the Nexus Q and NFC phones with Android 4.0’s Beam, the Nexus 7 ends up not being the most appropriate device to push the use of Google Wallet.

Since NFC doesn’t require a data connection, the reality of using the Nexus 7 at a coffee shop wouldn’t be that strange. You could pay for coffee before sitting down to read.

But the Nexus 7 doesn’t have a persistent data connection like a smartphone, so security is more physical. The security concerns that most have will be giving their credit card data to Google to store in their servers, which people might be uncomfortable with. But if you have a credit card with your Google Play account, it’s not that different.

What about iOS 6?

During Apple’s keynote discussing iOS 6, they didn’t announce NFC support. Considering the iPhone 4S would run iOS 6, there wasn’t a time to reveal if they would add NFC. When Apple has their September event with the rumored announcement of a new iPhone, iPad mini, and iPod Touch, it wouldn’t be surprising if Apple included NFC. Regardless of whether the new iPhone is changed physically, adding NFC support is expected.

The iPod Touch hasn’t seen an update for some time. Would it be that unexpected for the new iPod Touch to mirror the new iPhone and include NFC? That addition would make the stagnant media device relevant again by adding a new feature. If Apple released an iPad Mini to confront the Nexus 7 and also included NFC on that device, the newest Apple devices would all support NFC.

I can see iOS 6 receiving one last update to support sharing content through NFC from different iOS users, like Android Beam.

But what if Apple decides they’re going to release an NFC payment system? Windows Phone 8 will support NFC in a lot of different ways, and Apple won’t want to be the last to the party. So, theoretically, Apple could reveal an NFC payment system on iOS 6 for new devices tied into iTunes accounts for billing.

Will carriers deny Apple this option? Probably not because of massive business carriers get from selling iPhones and iPads. If Apple releases their own version of NFC payments, I can’t imagine carriers would deny the service.

It’s a waiting game

Google Wallet is a great step forward for unifying the smartphone into a multifunction device. While supported on the Nexus 7, its natural environment should be on an Android smartphone.

The big question is what Apple may do this Fall. If they announce an NFC payment app, will carriers finally give in and allow Google Wallet to become available for use? I personally think so.