Filling in your tax return can often be a headache – comparing the software available to help you do it equally so. This interesting post on the Getting Finances Done blog gives some really useful tips on software to take the pain out of making your tax declarations.

Filling in your tax return can often be a headache – comparing the software available to help you do it equally so. This interesting post on the Getting Finances Done blog gives some really useful tips on software to take the pain out of making your tax declarations.

As the author points out, it’s a nightmare trying to find out the difference between various packages available, so he’s kindly put together his own comparison of the best programs for US residents.

The good news is that, if your gross income is below $50,000 a year, then most of the tax software developers out there provide a free ‘standard’ edition. However, if you have a small business or earn over $50,000, he recommends ‘TaxCut’s Premium + State + E-file Online.’ The reason being is the overall cost of the package is excellent for the comprehensive investment, real estate and business ownership aspects that it covers. TaxCut are also one of the biggest and most reputable developers in the tax return industry.

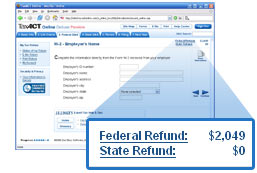

However, if it’s costs that worry you, he suggests going for ‘TaxActOnline.com Deluxe + State‘ which, although being a much smaller developer, offers pretty much everything you get in packages costing twice as much. On the other hand, if it’s only e-tax returns that you have to fill in, or you live in a state that doesn’t charge income tax, he recommends ‘TaxCut Basic + E-File Online’ or the totally free, ‘TaxActOnline Standard’ account. His overall conclusion was that:

TurboTax and TaxCut have some really nice value-added features that may justify the higher cost depending on your situation. If you’re looking for audit support, TaxCut is supported by hundreds of establish brick and mortar H&R Block locations. TurboTax will provide a ‘local tax professional’ in case of an audit, but who knows where they find the tax professionals. You could end up with crummy under-qualified representation. At least with H&R Block, there’s some quality control.

While tax returns differ from country to country, Softonic does offer a range of money management tools that focus on tax issues. Microsoft Money Deluxe is one of the most popular, helping you reduce your tax burden and make life easier when filling in your tax returns. It has a particularly useful tax forecasting tool which can help prevent any nasty shocks when you finally receive your tax bill.

If you’re in the US running a small business, then TradeAccountant is worth a go because it organises all your trading activity for federal tax reporting. Transactions are displayed in a simple table for quick reference and double-click editing. If you’re into the hiring business on the other hand, then Crystal Clear Hire is designed to take into account the special tax rules that affect this particular type of industry.

Finally, what do you do with all those completed tax returns for future reference? Your best bet is MessLess Collector which enables you to scan and store your returns with a handy date and text search built in so you can recall them easily at any time.