We carry these incredibly powerful but comparatively small computers around in our pockets all day, so it seems like a logical step that we should be able to pay with them. However, while many of us have had smartphones for years, paying with our cellphones has yet to really take off. Forrester believes this will change, as it predicts that US mobile payments will grow from $52 billion in 2014 to $142 billion by 2019. Fellow research company IDC paints a different picture, with its own report suggesting that most people don’t have a strong desire to pay with their phones. This is even in the case of mobile wallets, which add in loyalty programs, coupons, and rewards.

Whether or not mobile wallets have a bright future or not remains to be seen, but many of the big tech companies have already entered the market. We profile some of the main companies vying to become the mobile wallet provider of choice.

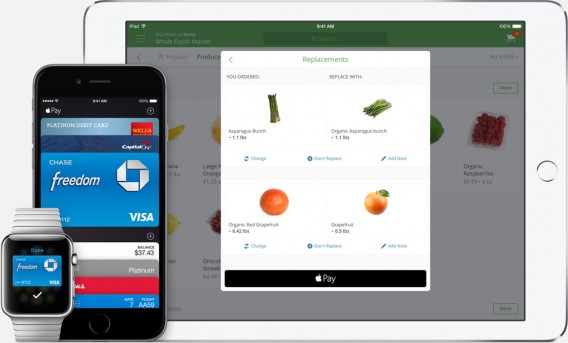

Apple Pay

Of course, when Apple brings out a product in a certain category, it tends to raise its profile a great deal, even if said product is not on par with the competition. When the company first unveiled Apple Pay to the world in September and announced it would be built into iPhones and the Apple Watch, there was a media storm of attention, while Forrester predicts that 2015 will be the year of Apple Pay. And the stats are there to back this up, with Apple CEO Tim Cook announcing in January that the service already accounted for two out of every three dollars processed through contactless payment systems. Add to that the fact that the number of supported bank and credit union accounts has significantly increased since launch, and that customer satisfaction levels are, so far, pretty high. An impressive debut.

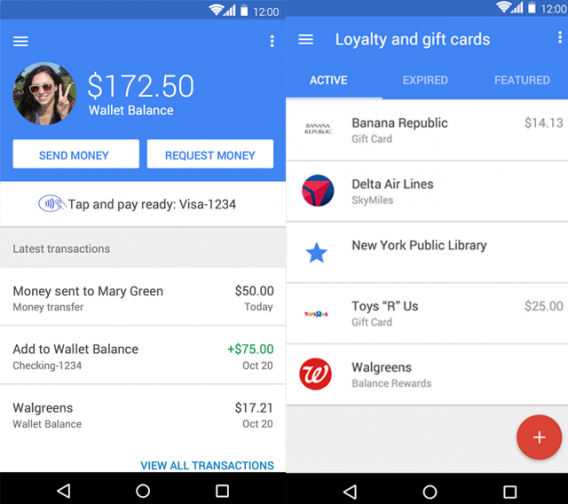

Google Wallet

The Google Wallet has been around for some time and, while it may be used for purchases in the Play Store and in other online stores, it has never taken off as an in-store payment method due to some complaints from network providers. But the company has been ramping up its activities in recent months, no doubt driven in part by the popularity of Apple Pay. In February, it signed a deal with Verizon Wireless, T-Mobile, and AT&T to pre-install the mobile wallet on their cellphones in the US. In the same month, it announced that it had bought Softcard which provides point-of-sale technology with the aim of increasing usage of Google Wallet’s tap and pay feature, which has been available since 2011. More recently, Google has been signing partnerships with retailers such as Dunkin Donuts that allows customers to pay before entering the store.

Samsung Pay

In March, Samsung threw its hat into the ring by announcing that it will be launching a new payment service called Samsung Pay. It allows people to make payments from their Visa or Mastercard accounts but using their phone instead of a card. What makes the Samsung announcement important is that the service will work at a lot more retailers than both Apple Pay and Google’s Wallet because it supports both traditional card readers, as well as newer contactless terminals. Samsung Pay will come pre-installed on Galaxy S6 phones.

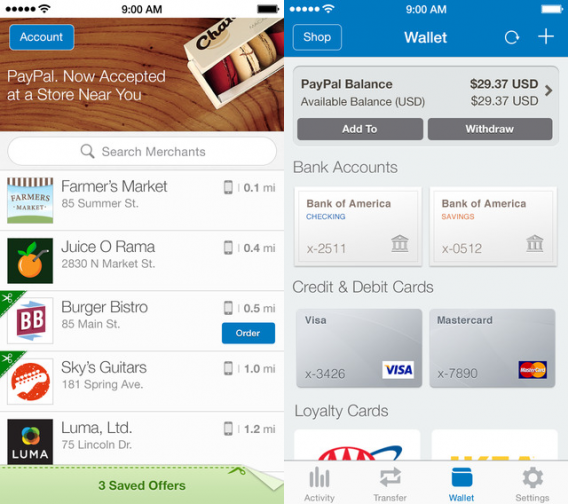

Paypal

Google isn’t the only company that is stepping up its mobile wallet offering due to the launch of Apple Pay. In March, PayPal bought mobile payments company Paydiant, which is behind mobile payment apps from retailers including Subway. The company has already had some success in the market, as its mobile payments volume grew 68% in 2014, from $27 billion to $46 billion.

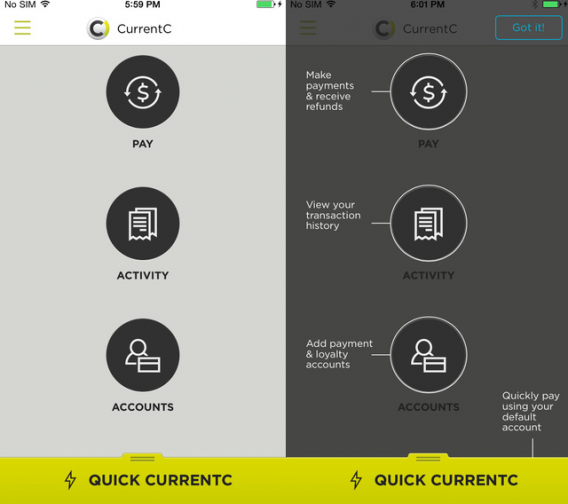

CurrentC

The mobile wallet space is not just reserved for the big name mobile companies, retailers are also chasing their own slice of the pie, most notably in the form of mobile wallet app CurrentC. MCX, the group behind this mobile wallet, is spearheaded by Walmart and scans QR codes rather than using NFC technology, which is only present in a small amount of retailers at the moment. CurrentC also stores your loyalty programs and promotions in the app.

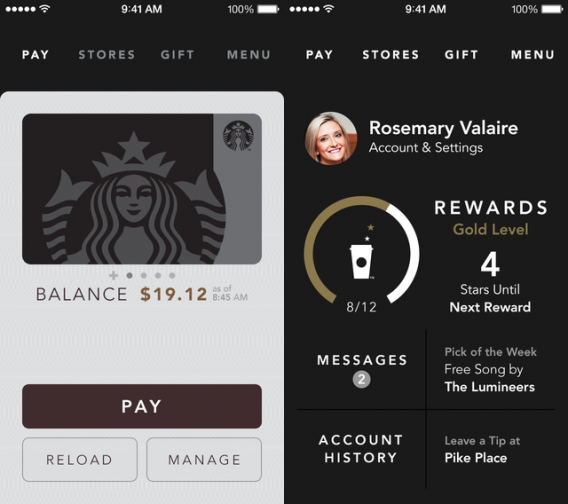

Starbucks

It may be Apple that generates all the headlines when it comes to mobile wallets, but Starbucks’ own mobile wallet app has been an immense success for the company. The coffee company’s mobile app, which allows you to pay for your coffee with a tap/wave of your phone, is not only used for payment but also for generating loyalty points. This is an added value that the likes of Apple Pay and Google Wallet have yet to address and point to the continuing success of Starbucks’ mobile wallet app, at least in the short term.

Microsoft

While Microsoft may not be yet be in the mobile payments market itself, the company has applied for payment licenses in all 50 states in the US. Currently, it’s Windows Phone platform is far behind both iOS and Android in terms of user adoption so that doesn’t give it as strong a base to launch a mobile offering from. Although this is an issue, the company is looking to address this problem by building Windows 10 for desktops and phones from the same code base.

Yoyo

Aside from the big names in the mobile space, there are a number of other smaller niche players in the space, such as British mobile wallet startup Yoyo. The company currently only offers its service to universities in the UK, but it is growing rapidly and is second only to the Starbucks app in the UK in terms of mobile wallets. Having recently received $10 million in investment, Yoyo – like Starbucks – processes payments using QR codes and is more than just a payment platform, as it also lets you earn loyalty points at retailers when you pay using the service.

Related Articles

Apple announces Apple Pay digital wallet

Apple Watch: everything you need to know

Follow me on Twitter: @karenmccandless